Cracking the Code: Valuing Pre-revenue Startups

Valuing a revenue-less startup is crucial for shaping equity, investor decisions, and fundraising. The process is akin to predicting the future and involves a balance of meticulous analysis and instinct. Startup valuation transforms ideas into numerical worth, guiding financial projections and strategies. This article will delve into the complexities of valuing a revenue-less startup and offer strategies to navigate this challenging task effectively.

What is Pre-revenue valuation?

Pre-revenue Valuation is a crucial measure of a startup's value, essential for both investors and entrepreneurs. Business owners can gauge their fundraising potential, while investors assess the equity share and growth prospects of the company before making investment decisions.

Investors typically receive equity in exchange for their investment, making it vital for them to accurately evaluate the worth of their ownership and the potential returns. The ultimate objective is to achieve a higher valuation for the startup.

Founders should strive for an objective valuation of their business to manage investor expectations effectively. While an inflated valuation may attract more funding initially, it can harm relationships with current and future investors if the business fails to meet expectations.

The Importance of Startup Valuation

Before discussing the strategies for valuing a startup company without revenue, it is important to first understand the significance of startup valuation, regardless of the company's registration status.

1. Funding Decisions:

Investors, including venture capitalists, angel investors, and individuals participating in crowdfunding, are required to assess the potential of a startup prior to making an investment decision. The valuation of a startup holds significant importance as it dictates the level of ownership that an investor will acquire in exchange for their financial contribution.

2. Equity Distribution:

For entrepreneurs and initial team members, the valuation of a startup plays a crucial role in determining the percentage of ownership that must be relinquished in exchange for investment. A higher valuation results in a lower level of ownership dilution. This underscores the significance of accurately valuing a startup company without any revenue.

3. Benchmarking:

Valuation serves as a vital metric for assessing the growth and achievement of a startup over a period. It enables entrepreneurs to monitor their advancement and make necessary strategic adaptations. This underscores the significance of valuing a startup company that has yet to generate revenue.

4. Strategic Planning:

Understanding the value of a startup is essential for establishing attainable financial objectives, designing employee compensation plans, and formulating well-informed strategic initiatives. Consequently, the assessment of a startup's worth, even in the absence of revenue, holds significant importance for various crucial aspects of the business.

Important Factors to Value a Startup Company With No Revenue

- Traction is Proof of Concept:

One of the key determinants of a startup's worth is its traction. Traction serves as a validation that the startup possesses a feasible and scalable business model, thereby contributing significantly to its overall value. Traction showcases the potential success of the business concept. Essential traction metrics include:

- Number of Users: A growing user base or customer list demonstrates interest and demand for your product or service, regardless of whether they are paying customers yet.

- Effectiveness of Marketing: Showing your capacity to attract valuable customers cost-effectively can be appealing to investors.

- Growth Rate: Demonstrating growth on a tight budget shows potential for rapid expansion with investment.

- The Value of a Founding Team:

Investors prioritize capable and dedicated founding teams. Consider these team aspects:

- Proven Experience: Having team members with successful startup experience can increase investor confidence.

- Skills Diversity: A diverse team with varying skills is more attractive.

- Commitment: Investors prefer fully committed teams for startups; part-time involvement is seen as a red flag.

- Prototypes/MVP (Minimum Viable Product):

A working prototype or MVP can significantly impact your startup's valuation. It shows investors your ability to bring ideas to life and increases the likelihood of securing funding.

- Supply and Demand:

Competitive industry landscapes impact startup valuations. More competition can lead to lower valuations, while high-demand markets can result in higher valuations.

- Emerging Industries and Hot Trends:

Startups in popular industries or trends can have higher valuations as investors seek the "next big thing.

- High Margins:

Investors favor startups with strong profit margins and high growth potential.

7 Ways to Value a Startup Company with No Revenue

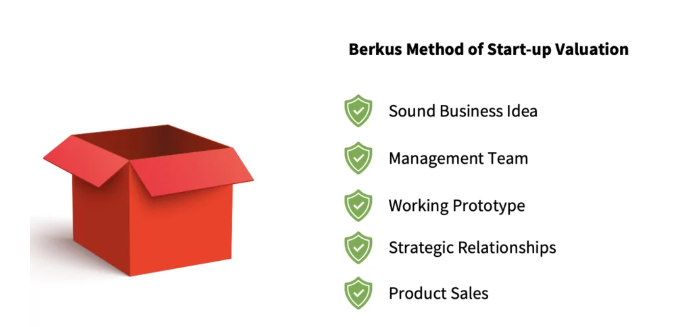

1. Berkus Method:

- Created by renowned angel investor Dave Berkus.

- Assesses five key components: concept, prototype, quality control, networking, and launch strategy.

Each component is assigned a rating, with a maximum value of $2.5 million.

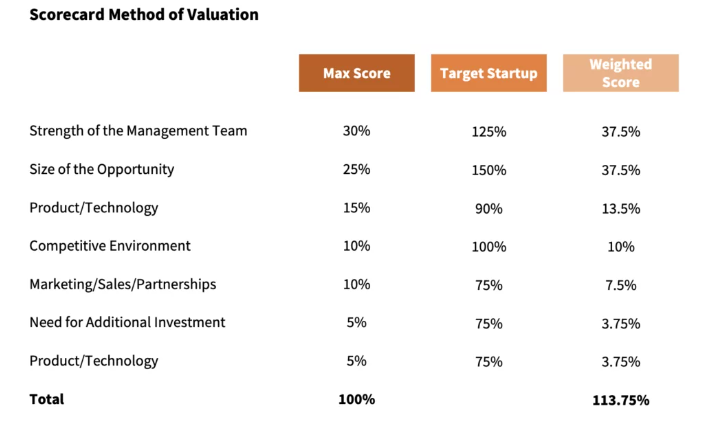

2. Scorecard Valuation Method:

- Conducts comparative analysis of the startup with other industry competitors.

- Evaluates various factors such as the strength of the management team, market size, traction, product/technology offerings, competition landscape, marketing/sales strategies, partnerships, growth potential, and funding requirements.

3. Venture Capital (VC) Method:

This process consists of two essential steps:

- Determining the terminal value

- Backtracking to establish the pre-money valuation.

The terminal value is derived from projected revenue, profit margin, and the industry P/E ratio.

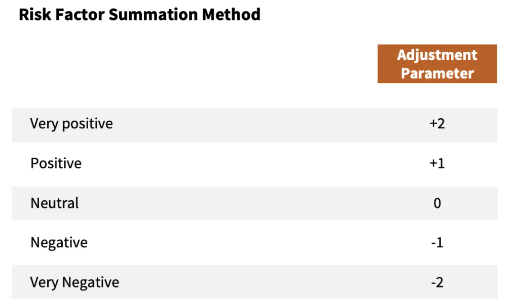

4. Risk Factor Summation Method:

- Integrates components from the Scorecard and Berkus methodologies.

- Evaluates a range of risks such as management, business stage, funding, technology, competition, legislation, and others.

- Risks are assigned scores that impact the valuation of the business accordingly

5. Combo Platter Method:

- Utilizes a blend of various methodologies to establish a valuation range.

- Includes analysis of comparable startups and evaluation of best, moderate, and worst-case scenarios.

- Provides a comprehensive overview of potential valuation outcomes.

6. Asset-Based Valuation:

- Emphasizes the startup's physical assets, cash reserves, and accounts receivable.

- Subtracts outstanding debts and expenses to calculate the asset-based valuation.

- Mainly analyses the startup's current condition and tangible assets.

7. Cost-to-Duplicate:

- Evaluates the expenses involved in relocating the startup's assets to another location.

- Offers a conservative estimation of the startup's worth focusing on its tangible assets.

- Neglects to factor in potential growth and intangible assets when determining